The Ultimate Guide To Pkf Advisory Llc

Table of ContentsPkf Advisory Llc Can Be Fun For EveryoneA Biased View of Pkf Advisory LlcPkf Advisory Llc Things To Know Before You BuySome Known Details About Pkf Advisory Llc The smart Trick of Pkf Advisory Llc That Nobody is Discussing

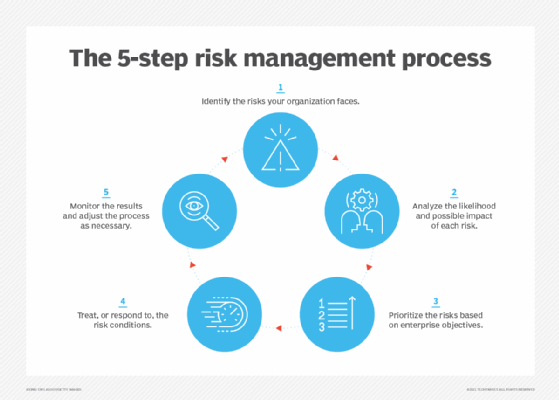

Centri Consulting Risk is an inescapable part of doing business, yet it can be handled through thorough analysis and management. The majority of interior and exterior risks firms face can be attended to and mitigated with threat advisory finest techniques. It can be challenging to measure your threat exposure and use that information to place on your own for success.This blog site is made to help you make the appropriate choice by responding to the inquiry "why is threat advisory essential for organizations?" We'll also examine inner controls and discover their interconnected relationship with company danger monitoring. Basically, company risks are preventable interior (critical) or outside dangers that affect whether you attain your business purposes.

Every company needs to have a strong threat management plan that information current danger degrees and exactly how to mitigate worst-case circumstances. Among the most crucial danger advising ideal practices is striking a balance between safeguarding your company while likewise facilitating constant development. This calls for applying international methodologies and governance, like Board of Sponsoring Organizations of the Treadway Compensation (COSO) interior controls and venture threat administration.

See This Report on Pkf Advisory Llc

One of the very best methods to handle danger in service is with quantitative evaluation, which utilizes simulations or statistics to assign risks certain numerical values. These thought worths are fed into a threat version, which produces a variety of outputs. The outcomes are assessed by risk managers, that make use of the data to identify service possibilities and minimize adverse outcomes.

These records additionally include an assessment of the impact of unfavorable end results and mitigation strategies if damaging occasions do happen. Qualitative threat devices consist of cause and impact diagrams, SWOT evaluations, and decision matrices. Created by the Institute of Internal Auditors (IAA), the three lines of protection (3LOD) model offers a structure for recognizing, dealing with, and mitigating business threats and risks.

With the 3LOD design, your board of directors is liable for threat oversight, while senior monitoring develops a business-wide risk society. Liable for possessing and mitigating risks, functional managers manage everyday company ventures.

A Biased View of Pkf Advisory Llc

These jobs are typically managed by economic controllership, quality control teams, and compliance, who might also have responsibilities within the initial line of protection. Interior auditors provide objective guarantee to the very first 2 lines of protection to make sure that risks are handled suitably while still meeting operational objectives. Third-line employees should have a straight connection with the board of directors, while still keeping a connection with management in economic and/or legal capacities.

A thorough set of inner controls must include items like settlement, paperwork, protection, permission, and separation of duties. As the variety of ethics-focused investors remains to enhance, numerous businesses are including environmental, social, and administration (ESG) requirements to their internal controls. Financiers use these to identify whether a firm's worths line up with their very own.

Social criteria examine how a company handles its connections with employees, customers, and the bigger area. They additionally raise performance and boost conformity while enhancing operations and helping avoid fraud.

The 15-Second Trick For Pkf Advisory Llc

Constructing a thorough collection of interior controls involves approach positioning, standardizing plans and procedures, procedure documentation, and developing roles and duties. Your internal controls need to integrate risk advising best methods while always staying focused on your core service goals. One of the most effective inner controls are tactically set apart to avoid possible conflicts and minimize the threat of financial fraudulence.

Developing good internal controls includes implementing policies that are both preventative and investigative. They include: Limiting physical accessibility to tools, supply, and cash Separation of tasks Consent of billings Confirmation of expenditures These backup treatments are made more info here to spot unfavorable results and dangers missed by the very first line of defense.

Internal audits entail a comprehensive examination of a business's internal controls, including its accounting techniques and business management. They're made to make certain regulative compliance, along with exact and timely economic reporting.

The 2-Minute Rule for Pkf Advisory Llc

According to this regulation, management teams are legitimately in charge of the accuracy of their business's economic statements - pre-acquisition due diligence. In addition to safeguarding financiers, SOX (and inner audit assistance) have substantially boosted the reliability of public accounting disclosures. These audits are carried out by objective 3rd parties and are created to review a firm's bookkeeping treatments and inner controls